In the first part, we looked at Bitcoin’s success criteria.

The path to adoption for me is – how do people that want to use Bitcoin for some reason get their hands on it? I don’t care about the numbers – how many countries, institutions or individuals are using it, or what monetary unit the price of a flat white in a coffee shop is using. I’m interested in precisely whether everyone who wants to use Bitcoin has that option.

I prefer the criteria from “inside” the community – what is the availability for people who want it. The “from the outside” criterion (does every resident of my village have Bitcoin?) doesn’t interest me that much. Now we’ll look at the different paths to adoption – that is, the ways people get Bitcoin. These paths all run in parallel. Regardless of what we think is the best path, they all are happening at the same time. What we can do is “amplify the signal” of one path or another.

Adoption using financial institutions

Many people are cheering for financial institutions to make Bitcoin available to some segment in some form. Companies like Revolut, PayPal, and the like have made Bitcoins available in “bankcoin” form, where one can buy Bitcoin using the institution’s app with one click.

However, Bitcoin purchased in this way does not provide what Bitcoin is for, in my opinion. I’ll repeat from the previous part: Bitcoin provides protection from confiscation, excessive taxation, inflation, capital restrictions (easy transfer across any border), and regulatory hell.

If I buy bitcoin through Revolut, PayPal, and similar apps, I am not protected from any of the above. Thus, I have bought a product at the same price as real Bitcoin, but one that does not provide all the benefits of Bitcoin.

I may find out that when I want to sell it, I will be faced with some AML/source of funds form without which I won’t be able to get my money. Often the only way to “withdraw” my Bitcoin is to convert it into fiat in the app – often with automatic reporting to various institutions. That way I “undress” in front of the institutions and all I get is speculation on the price. Worse, this speculation may not work, because unlike Bitcoin, which I own if I can sign a valid transaction, with “bankcoin” I have to ask the institution to send me my Bitcoin (which is already possible with Revolut, for example) or exchange it for fiat.

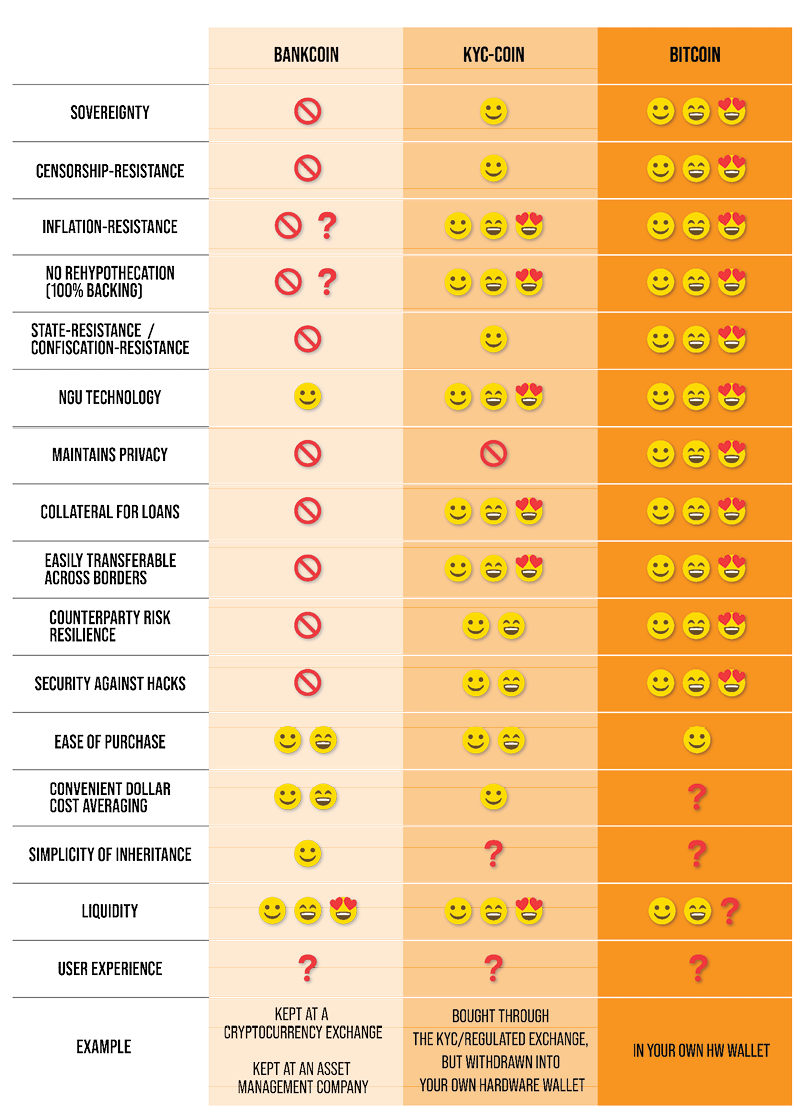

Image: I recognize different forms of Bitcoin. Bankcoin is Bitcoin stored at an institution (I don’t have private keys). KYCcoin is Bitcoin in my wallet, but without privacy (I undressed in front of some institution and gave them my private information). Bitcoin is Bitcoin as it was intended. Despite the nearly identical price, these products have significantly different characteristics. You can learn more in a chapter How to give Bitcoin back its peer to peer character and use it to its full potential from my book Cryptocurrencies – Hack your way to a better life. Also available on Amazon and also in Spanish).

What is not so important here is whether this bankcoin is “paper” (e.g. composed of derivatives), rehypothecated or really backed 1:1 by real Bitcoin. What matters is that it’s an IOU – a claim on the bank that is settled in fiat currency if you meet conditions unknown to you in advance.

If someone is willing to buy a product for about the same price that has none of the features of Bitcoin other than replicating its price, I don’t think they’ll be happy with their purchase. Add to that the risk of such a centralized institution being hacked, or going bust (and years of hassle to liquidate – in the best case scenario), and the sense of user-friendliness is not nearly as rosy as these institutions portray it to be.

Filling out AML forms, notarizations, documenting sources of income and other – not known in advance – bureaucratic tasks are, in my opinion, more user-unfriendly and time-consuming than setting up a hardware wallet with a good inheritance setup.

Funds (ETFs), stock and bonds

In 2017, we’ve been hearing the same song over and over again – the institutions are coming! The proponents of this adoption path were thinking of pension funds, exchange-traded funds (ETFs), or large institutions that will buy bitcoin on balance sheets. This is partly what has happened.

If there are Bitcoin ETFs available, then any broker and even most retail banks can sell you this ETF. In addition to the ease of purchase, many states also give ETFs a tax advantage, using so-called time tests (when you hold an ETF for more than a certain amount of time – usually one or three years – the sale is free of capital gains tax).

The ETF also has a statute and an information leaflet that communicates the expected risk. Since I’m a bit of a risk-taker, to me it’s akin to watching an action movie in which the main character shoots the tire of a speeding car with one hand from a salto – the genre is called comedy, and ETFs’ and funds’ claims about risk should be treated similarly.

However, similar to selling through bankcoin financial institutions, this adoption route introduces fragility into the system and does not bring users all the benefits of Bitcoin. It’s a game of future value – if the state allows it, if you fill out the right KYC and AML forms, if the bank accepts the incoming fiat transfer, then you’ll likely get to the future value, minus all the taxes.

If you on the other hand need to use “your” bitcoin – to flee the country with your assets, for example, or to protect your assets or purchasing power, it may not work. You can also partially invest in Bitcoin in the form of shares in companies who buy Bitcoin on their balance sheets or mine it, or with special bonds that are exposing you to part of the Bitcoin price movements. I won’t name specific products because I don’t recommend them. This is not a good road to adoption. Avoid it, don’t shill it, don’t cheer it. It’s in no way “easier” or “user-friendly”, it’s a user experience disaster.

Interlude: Is all adoption good?

Bitcoin adoption via bankcoin is supposedly a desirable thing – it will make Bitcoin more accessible to people, they will realise its benefits and gradually want to hold it themselves. That’s what I’m told by Bitcoiners, who say that many people they know personally find it quite difficult to use normal Bitcoin, let alone OTC/p2p traders.

This is told to me by people who therefore know how to do it right and know the people they are talking about personally. So I ask, why, with peer to peer electronic cash, would these people use the services of some bankcoin institution when they know someone who can help them buy Bitcoin in a way that they have private keys (and thus custody) and really take advantage of all its benefits? Is that laziness to help your fellow people?

Here, I’d like to say that I really think that setting up a hardware wallet and buying Bitcoins – especially if I know a Bitcoiner nearby – is significantly easier than setting up a bankcoin account. Yes, signing a contract, taking an ID, waiting for verification, answering questions about your financial situation and the origin of your funds might not be such a problem (by the time you complete this process, you would have installed Trezor One, upgraded its firmware, created a backup of your wallet, and have gone through initial training on how it works).

But what many people don’t know is that when they want to make use of their Bitcoins (usually the only option is to sell it for fiat), they are often faced with additional questions, verifications, either from the bankcoin institution, theoretically from the bank, plus they will very likely be reported to various government institutions.

A lot of people who want to withdraw their assets will see a pop up: “before you proceed, we need to ask you questions about the origin of the funds”. But that is not even a worst case scenario, sometimes it’s a form that you have to sign in front of a notary and mail it in. Is this really the experience we want to convey to Bitcoiners? Is this the new, parallel, free money? Of course, the easiest thing for any Bitcoiner to do is to ditch their buddies, let them go to a bankcoin institution, and enjoy the fact that them buying Bitcoins through the institution will pump up the value of their Bitcoin (although if anyone believes this, I suggest looking at the daily volume of Bitcoins traded – you don’t have friends rich enough to pump your bags).

The real story of adoption

I’m sitting at a friend’s cottage. Suddenly, my friend’s mom comes over with Trezor One in her hand and plugs it into the computer, which is playing music. Another friend shows a Bitcoin address, where my friend’s mom sends him Bitcoins. The friend hands her cash.

Neither of them are “IT people” – the mom is an artist and my friend is a medical doctor. I sit in mute amazement and smile. This story really happened. Exactly like this. And I had nothing to do with it – I had no idea that such an exchange was about to take place, let alone mediated it in any way.

This is a story of adoption that you won’t see in the coinmarketcap charts, or in the market statistics. It is peer to peer electronic cash. Two people with opposite needs decide to solve them. No need for a PhD in cryptography, not even reading of my books or taking my courses. Less experienced people just need half an hour with someone who knows Bitcoin already. This is organic adoption. Everyone involved had bitcoin in the right form, with what I think are the right goals. They use it as peer to peer electronic cash to solve their life needs. They are really hacking their lives.

The best road to adoption – community adoption

Community adoption is important. We like to look at centralized entities, measure adoption using a variety of metrics, mostly from centralized entities, and base success on criteria that are common to the traditional financial system. But… we’re not in a classical financial system.

The point of Bitcoin is creating a parallel financial system that provides something that the classical financial system cannot provide. You don’t trade a US Treasury bond or Tesla stock options hand-to-hand at a cabin in the Tatras. The classical financial system needs centralised entities because it is built differently.

On the other hand, Bitcoin is peer to peer. Decentralized. Permissionless. And that’s what adoption should look like. If someone finds it difficult to run a hardware wallet and buy Bitcoin in peer to peer mode, let’s help them. If they’re good friends or family, we’ll do it for free and gladly. If the good deeds are already starting to go over our heads, we can make a living by helping people get Bitcoin the way it was intended. We can provide the service of setting up wallets and making Bitcoin available.

Who is an OTC trader and who is a regular participant in the Bitcoin network?

If someone needs to pay rent, or wants to go on vacation, and needs to sell Bitcoins for fiat (because they don’t have the option to buy directly), they are an organic counterparty to the trade.

The other party is someone who wants to buy Bitcoin to save (HODL).

In this case, it is an organic trade and in most cases it happens without a fee. The counterparties can be found in a peer to peer trading group or via an app such as Vexl.

A professional ethical OTC trader is someone who makes bitcoin available to others as their livelihood – whether primary or supplementary.

The advantage of a OTC traders is that he or she is a counterparty to the trade even in the absence of an organic counterparty.

If Bitcoin price plummets and everyone wants to buy, or the price rises and many people want to sell, it is harder to find an organic counterparty in such an unbalanced market.

Cheap Bitcoins are only sold by someone who really has to sell them, others just wait. An OTC trader on the other hand has no opinion on the price and has hedged the exchange rate. So the OTC trader is a very useful liquidity provider in such situations and is part of organic adoption.

Image from my short ebook Cypherpunk visions and trends 2023-2025.

People often do not see the informal, organic and decentralised economy as equal to the institutional and official. However, in many industries it mediates products and services much better than centralized “one click” companies with their own app. If you need to plough your garden in a village, you probably go straight to a neighbour who has a tractor and a plough, pay him money and in two hours you are done. Need to cut wood? You probably won’t go to a centralised shop, but you’ll approach a neighbour with a saw.

Need to buy bitcoin? Don’t know how to do it? You’ll probably reach out to someone in the neighborhood who knows what they’re doing and ask them to help you with it. The more inquiries they get – and the more they make from it (both in percentages and absolute value), the more time they can devote to making Bitcoin available. The more people around them have Bitcoin, or at least experience with it, the better they can balance the counterparties to the trade.

The ideal market structure of the Bitcoin economy

The market structure of the Bitcoin economy is “node-first”; it is not a centralized hierarchy, but it consists of specialized individuals who interact with each other. Alongside this, of course, runs traditional hierarchical adoption through institutions, but that is not a success criteria in my view, is not that desirable to me (but you may have a different opinion and it will happen regardless of what I think of it), and does not take advantage of the full potential of Bitcoin.

Peer to peer electronic cash means node-first, peer to peer, non-hierarchical relationships and electronic cash – with cash features like anonymity, fungibility and the like (which is why I recommend using Lightning).

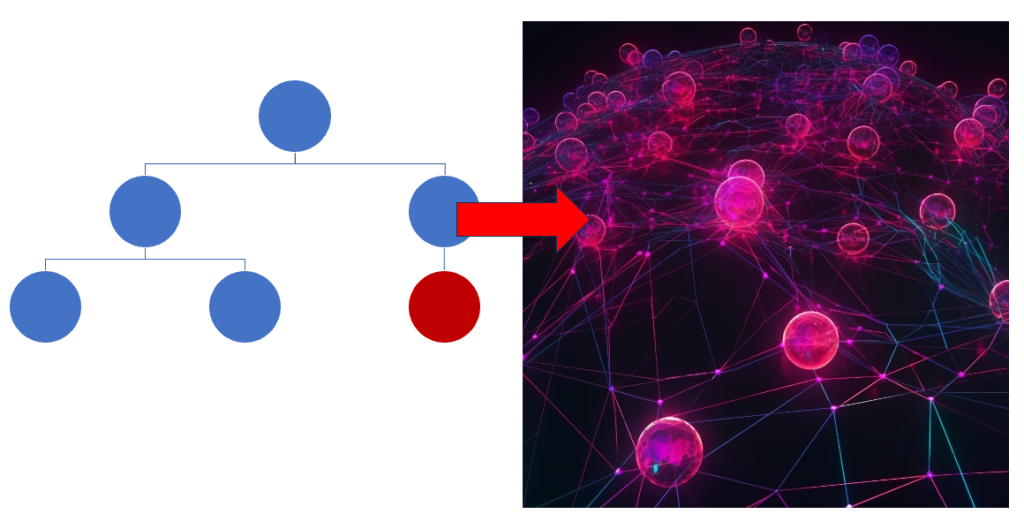

Image: The transition from hierarchical relationships to peer to peer relationships, which are much more varied. Individual nodes (individuals) specialize and collaborate with many other nodes. The nodes who specialize in what they are great at (unique ability) by being self-directed lead to a much more fulfilled lives of the individuals participating in this kind of market structure. Read more in Searching for gamma: How to show the middle finger to the hierarchy.

However, the individual nodes in a peer to peer network do not have to be the same – they can’t even be. I specialize in “power users” – I have content for beginners as well, but my goal is to create smart users who can handle volatility, use more advanced options like collateralized lending (to short fiat), or even make bitcoin available to people as P2P OTC traders. If someone is really interested in Bitcoin, I can impart very unique and advanced knowledge to them – whether in their personal life (Cryptocurrencies – Hack your way to a better life) or in business.

Of course, there are a lot of people who are dedicated to educating Bitcoiners, and my content or point of view does not suit everyone.

These Bitcoin “power users” that I teach can then help other people and can make Bitcoin accessible to people who don’t know how to setup their own wallet, or how would they even start. They can install them a wallet, show them the Vexl app, sell them their first Bitcoins, explain security and what to look out for, or organize a meetup for them.

They can help establishments to accept Bitcoin. And then we have individual sovereign users who save in Bitcoin or buy and sell goods and services with Bitcoin. This is organic adoption in my view, using the organic market structure.

Conclusion

There are many roads to Bitcoin adoption. Personally, I prefer decentralized options that don’t deprive users of sovereignty or privacy. I have mentioned a few avenues, but there are of course many more. For example, many people will leave a centralized platform like X or Facebook and switch to Nostr. They will start getting “zaps” and only find out after a while that the zaps are actually real Bitcoins and not just meaningless “likes”.

There is no point in trying to prevent any road to adoption, but the organic and decentralized path is a more natural one for Bitcoin, and in this case, quality is better than quantity.

Can you help those around you with Bitcoin so that they have a good experience? Can you explain the risks, give advice on setting up a wallet? Will you sell them a hardware wallet, or the Cryptocurrencies book, so they have something to consult for questions that come up later? What unique skills do you have that you can use in this fascinating market structure?

What’s beautiful about Bitcoin is usually the parts that you can’t see. I wonder how many people-to-people trades will take place the way my cottage experience happened – invisibly, just like that, peer to peer.