This is a chapter of my book Cryptocurrencies – Hack your way to a better life (my eshop, Amazon, Slovak version, Spanish version my e-shop, Spanish version Amazon). In this chapter I talk about the fact that you can buy different “versions” of what businesses sell as Bitcoin – for the same price – but with vastly different properties. Do not fall for the scams of “bank” Bitcoin and KYC. They are not the same as Bitcoin.

Imagine there is an economic crisis, supply chains are not working and there is a high demand for cars. If you bought a car and sold it a year later, you would earn more than the normal officially calculated price inflation. But since owning a car is terribly complicated, you decide to just buy a car certificate instead of a car. This certificate says that you own the car, but you can never physically get to it. You can only sell it – for dollars. You will never see the car. You can use it as a speculation to earn on the price increase, but you can’t do anything else that a car normally does. You can’t drive it into the woods and sleep under the stars. You can’t drive it on holiday, take the kids to school or go to work. If you need to carry a box of heavy freshly printed books about Cryptocurrencies from the printer to the distribution company, you can’t – because you don’t have a car, all you have is a piece of paper saying that someone has your car and is charging you for storage. You don’t have someone to call to say “I would really like to use my car right now, I’ll come get it”. The company that issued the certificate tells you “we can sell this paper on the market for you and you can buy a car for dollars at a car dealer”. That doesn’t mean that there is no car, of course – it is probably parked somewhere far away where car registration and storage is cheap. But the only possible interaction with it for you is to instruct the company that stores it for you to sell it for dollars and wire you the proceeds.

Even though people say all car metaphors are wrong, I decided to use this one. This is exactly how Bitcoin stored with third parties works. You pay the full amount for it as if you were buying it in your own hardware wallet, often even paying fees for exchange (entry and exit fees) or custody (“portfolio management”). Of course, the company you do this with reports everything to several authorities. And often (though not always) all you can do with such a “bankcoin” is sell it for fiat. Which can mean all sorts of inconveniences – like tax obligations.

But what could we do with Bitcoin if we actually had it in our wallet? Isn’t the point of Bitcoin simply to wait for it to increase in value and then sell it? What is the analogy of “driving” a car, listening to music on its sound system, or sleeping in the back seat?

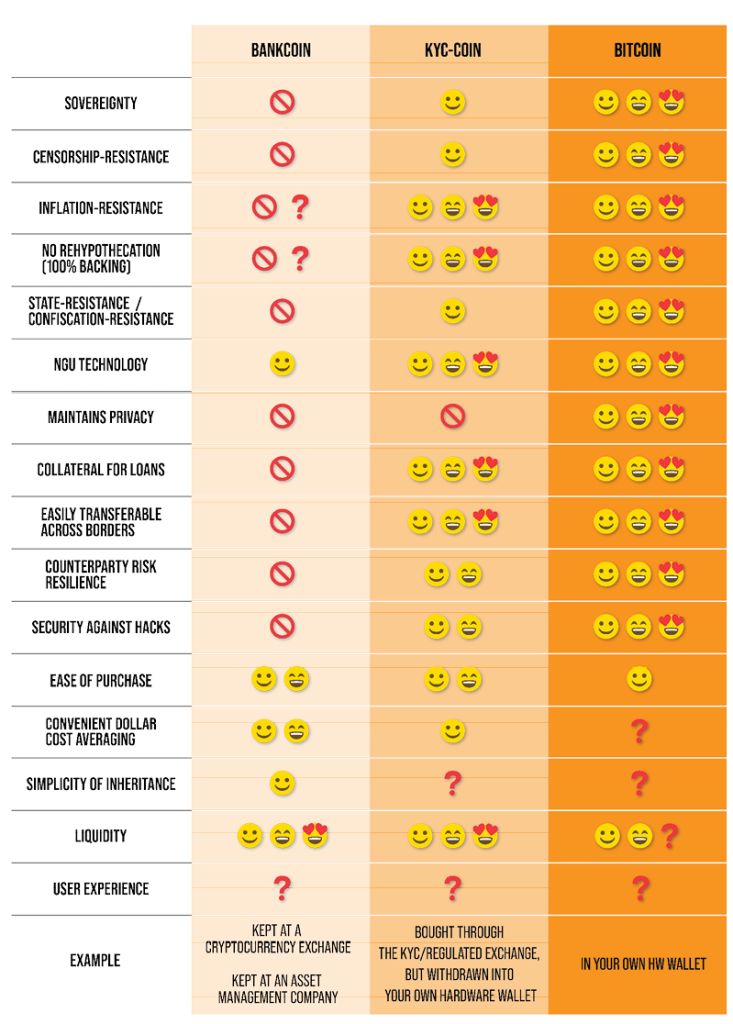

I have prepared a table of the different options for what can be done with Bitcoin. I’ve broken down three distinctly different forms of Bitcoin that people refer to as “Bitcoin”. The first is something I call bankcoin – it’s Bitcoin stored with a third party. This can be a custodian company (PayPal, Revolut, …) or you can have it stored “on an exchange” (Coinbase, Kraken, …). This method of ownership is characterized by the fact that you don’t have private keys and thus the ability to send a signed transaction to the network. In certain circumstances (for example, if it’s a balance on an exchange) you can ask the exchange to send Bitcoins to an address. Beware, this is not always an arbitrary address – most exchanges, thanks to FATF-GAFI regulations recommendations, only allow withdrawals to your own wallet. So you can’t send such Bitcoins to just any address, but only to one that you directly control.

(This is written in those terms and conditions that no one reads and clicks “accept”, somewhere on page 30. In practice, this translates into the fact that when you request a cryptocurrency withdrawal, the exchange may ask you to sign a declaration with the private key corresponding to the recipient address that says that you own this address. This happens most often if it’s a withdrawal to another exchange, and using the Travel Rule, the two exchanges tell each other who the account holder is and find that the names don’t match for these accounts.)

The second coin we will examine is what I call a “KYC-coin“. This is a bitcoin that you bought on an exchange where you revealed your identity through the KYC (Know Your Customer) process. In this case (as with the bankcoin), you probably sent the exchange a photo of your ID, some proof of address, and maybe you also went through online biometric verification and rotated the ID so that the app could verify the hologram on the document or other security features. This is an account that’s directly linked to you, and therefore the exchange can and probably will tell third parties about that account – who you are and what you’re buying. Third parties can be various tax authorities, financial police, chain analysis firms and various other institutions. A KYC-coin differs from a bankcoin in my comparison in that after you have bought it, you have withdrawn it into your own hardware wallet. Thus you have private keys and the exchange no longer controls your coins, it just knows that you bought them.

By “Bitcoin” in this comparison, I refer to Bitcoin that is not directly institutionally linked to your identity and is also held in your own hardware wallet. You could have accepted it as payment for work, goods you sold, financial settlement, or you could have bought it anonymously – from a friend, a crypto trader, a Bitcoin ATM without identity requirements, or anyone else.

How to get this self-sovereign Bitcoin without KYC, as it was intended? Check out the Vexl app, which is an open-source non-profit app that allows you to find a counterparty for buying (or selling) Bitcoin as it was intended. Also check out their cool video on why this is important:

Sovereignty

Sovereignty over one’s own property is one of the main characteristics of Bitcoin. This includes the fact that Bitcoin belongs to you and you alone – you can decide how you want to use it. If you want to spend it, you can spend it as you see fit. If you want to keep it, you can keep it, and no one can take it from you without you agreeing and signing the transaction.

Bankcoin in this case is the worst option. You use it by instructing a third party to do something with it. “Please sell it for dollars and wire me the money”, or “Please sign a transaction and send it to my wallet” (not all custodians support this operation, for example at the time of writing this, you cannot withdraw “your” bankcoin-bitcoin from PayPal or Revolut to your own wallet, let alone an arbitrary wallet).

Of course, the problems do not end here. This third party may go bankrupt, be ordered by a “higher power” (the state) to freeze your account, or outright send your bitcoins to a different address. You often can’t do anything with a bankcoin except sell it. But even if you can withdraw it into your own wallet, this is also subject to the consent of a third party who will sign off on the transaction based on your instructions.

So with bankcoin, you have almost no sovereignty compared to KYC-coin and Bitcoin. KYC-coin has only one smiling emoji out of three in the table. It is true that your bitcoins cannot be moved elsewhere by the exchange anymore, because they are in the hardware wallet that you and only you control. But various events can occur, such as Executive Order 6102, with which in 1933 Franklin D. Roosevelt stole gold from the American people. That is, he decreed that all those who owned gold had to sell it to the state for a specific price. If you have a KYC-coin, in a situation like this, you’d be hard pressed to get away with not having any bitcoins, especially if you’ve already listed them on some reporting form and haven’t yet taxed their sale. Similar situations have been common since 1933. In Iran, for example, while bitcoin miners can legally mine bitcoin, they have to sell them to the state – specifically the central bank.

I’m not suggesting any violation of democratic laws here, I’m just warning that democracy can become a dictatorship at the snap of a finger, and then there can be institutionalized theft. Most people when discussing sovereignty tell me some story that they are going to tell the state – for example that they mixed the coins in a coinjoin mixer, sold them for monero or that they “somehow” lost them (the famous “boating accident” story). Is that a good strategy?

With a KYC-coin, the primary issue is not the specific coin and its identifiability in the blockchain. Bitcoin does not “travel on the blockchain” with a sticker with your name on it. The primary issue is the information that the exchange knows – you bought $357 worth of Bitcoin on the exchange on 9/1/2022. This information is automatically sent to the tax authorities by the exchange if it is considered a “reportable account” within the CRS, using FATCA or under other local regulations that might apply to either you or the exchange. These reporting and financial surveillance agreements do not need a court order, do not need a reasonable suspicion and are often automated and broad. If it comes to confiscation, there are only two options – either you still have the coins (show them in your wallet and hand them over) or you have used them (show in which year you declared the sale of the “virtual asset” in your tax return).

The term “virtual asset” is a “statespeak”, just as in the novel 1984 there was a Ministry of Truth and a Ministry of Love. States resist the term “cryptocurrencies” as much as they can because they are supposedly not currencies, money. And the prefix crypto is terribly dangerous, because it expresses the very sovereignty mentioned above. That is why, although we all know that they are talking about cryptocurrencies, states are talking about some “virtual assets” in order to emphasize that they are virtual and therefore not real. In that case, however, we should also refer to fiat currencies as virtual assets, which are also largely electronic and have been created in a database of some kind – as a virtual record. A similar “statespeak” concept is the notion of an “unhosted wallet”. My hardware wallet is simply a cryptocurrency wallet. No one has ever called it an unhosted wallet. But states have started talking about the fact that there are some special unhosted wallets (which are just normal wallets) to distinguish them from some hosted wallets, which are only minimally used in the crypto industry. The “hosted” ones (we call them “custodial”) are the ones that are weird. If you want to understand the minds of the politicians and bureaucrats, the words they repeatedly use and the words they avoid provide a good look into their heads. And it’s not a pretty sight.

The official may not care at all if you mixed the coins on the chain using Wasabi Wallet or Whirlpool mixer, exchanged them for Monero or sent them via Lightning. Either you have them and they are confiscated or you used them and owe taxes to the government.

A common second strategy of people is the so-called “boating accident” – you were on a yacht with your hardware wallet, a wave came and the wallet fell out of your pocket and you lost your coins. Or someone stole them from you. That excuse works a lot less often than people think – especially in the possible dictatorship we want to defend ourselves against. And it needs to be well documented. Did they steal your coins? If you know that a crime has been committed, you are obliged to report it in many cases. Do you have a police report? (A false accusation is also a crime, so going to file a fabricated criminal report is not a good idea). Have you been on a yacht? How did you pay for it? Who was with you and can testify to this. Were there big waves at all back then? And why have those coins of yours moved since the boating accident, when the only private keys were drowned?

For me, all these excuses just don’t work in a dictatorship, and the effectiveness of key extraction if you are physically in such a violent setup will be high. People like to daydream and theorize about how they’re going to get away with those in power – I also often have dreams about how I’m going to heroically single-handedly defend an entire village from invaders thanks to my black belt from Tae Kwon Do. But when the shit hits the fan, that’s not likely to be the strategy I’ll use in a conflict.

Censorship-resistance

Part of sovereignty is censorship-resistance. This means that I can create a valid transaction and the network will process it, regardless of third-party decisions. With bankcoin, you often can’t do the transaction at all – the only way to withdraw money is to sell it for dollars. But if it’s a balance you hold with a cryptocurrency exchange, you can withdraw it unless another circumstance has occurred – the exchange has been hacked, is bankrupt, or your account has been frozen because you haven’t sent a new selfie in a year, or the exchange is in doubt about whatever they can be in doubt about.

An example is the experience of a friend of mine who had his account with a balance of about ten thousand dollars blocked by such a bankcoin institution because they didn’t like a $100 transaction he made a few months ago. And the technical support was in no hurry to resolve this problem and accept the explanation. So my friend had his account blocked for several weeks with a balance hundred of times higher than the value of the problematic transaction. It turned out that the transaction was not problematic after all.

Bank account users often have a similar problem. There are many cases in my area where the bank decides that they just need to see documentation on the source of all your income and in some cases, if you don’t provide it on time, they freeze your account.

People argue that the term censorship is out of place, but I think it is really the right term – financial communication is communication. And making it impossible is censorship.

On Twitter, a user asked Jesse Powell, CEO of the Kraken exchange (at the time I write these lines, it was the fourth largest crypto exchange by spot trading volume), if it was possible that the police would order them to freeze a customer’s account without a court order. He wrote back (paraphrased, click link for original tweet): “100% yes, it has happened and will happen and 100% yes, we will be forced to comply with such an order. If you are worried about it, don’t keep your funds with any centralized/regulated custodian. We cannot protect you. Get your coins or cash out and only trade peer to peer”.

With a KYC-coin, unlike a bankcoin, it is not possible to prevent a transaction from being sent, but it is possible to punish circumvention of the imposed censorship. No one can “freeze” your cryptocurrency balance in your wallet by technical means, but they can punish any movement of the balance. When they see your coins and on a transparent blockchain they move, that can be a problem. This problem can be partially addressed by a payment method that doesn’t have a permanent record of transactions let alone with a timestamp – such as using the Lightning network. However, you need to have the channels open before the problem arises. However, it is better to switch from KYC-coin to Bitcoin.

Monetary inflation

Inflation originally meant the growth of the money supply. The money supply is inflating, prices are not inflating but rising (note another case of “statespeak”). So this section is also about monetary inflation, or inflation in its original sense – the growth of the money supply. We know that there will be 21 million Bitcoins and no more.

Price inflation is predominantly a monetary phenomenon and is caused by money printing, i.e. the production of new monetary units. In the short run, prices may also rise because of some shortage, but usually this is only for specific goods and doesn’t cause an overall rise in the price level. Central bankers like to make the excuse that various unforeseen circumstances (pandemics, Putin, the climate crisis, etc.) are to blame for price increases. What we know for sure is that when someone prints new monetary units, prices will rise. At the same time, we know for sure that new monetary units are created by central bankers, commercial banks and other institutions, and so we can regard their talk of “unforeseen circumstances” as a distraction from the real cause.

Interestingly, new fiat money units can also be created by commercial banks and even blockchain projects such as MakerDAO. That is the reason why we don’t actually know exactly how many new monetary units there are – a database entry is pretty much free.

With Bitcoin, we don’t know what the prices will be, because as I write these lines, the Bitcoin economy is still a small slice of the overall pie, so it doesn’t have that much of an impact on prices. But the cause of the problems (counterfeiting money, giving away new units to friends, central planning of consumption, subsidies, financing states through debt) is clear and is not a threat with Bitcoin. Not even with a KYC-coin.

For bankcoin, we cannot tell if they are creating virtual account balances that are not backed by real reserves (true Bitcoins), although some bankcoin institutions allow us to verify this with cryptographic proof of reserves. That’s why I put a question mark next to the ❌ in the case of bankcoin.

The advantage is that such monetary inflation does not have a large impact on the rest of the market. Fractional reserves may cause the collapse of a particular financial institution, but they do not have that much impact on real reserves.

Lending

How the institution handles the coins is also related to the backing. Does it lend them to third parties to earn additional interest?

Again, with bankcoin, this can be verified in certain specific cases, but in general we don’t know. In recent bankcoin institution failures, we have found that they did not take care of the money in the way they said they would. They were making uncovered loans that the borrowers did not repay. That can’t happen to you with Bitcoins in your wallet.

NgU technology

For many people, the point of Bitcoin is the so-called “Number go Up” technology. That is, they specifically want to open an app where they can see their cryptocurrency balance and they want the number that represents the fiat value of their account to go up. There’s nothing wrong with that, and working with volatility and the hard money property is something you’ll read about in several places in this book. And you’ll also read that the number expressing the fiat value can also go down – and quite substantially.

Bitcoiners call the fiat-value-increasing property “NgU technology”, “NgU tech” or “Number go Up”. It’s kind of an ironic comment on how people will put a complex technology such as Bitcoin into a simple box, while it is much more than one number going up – it is supposed to create a whole new sector of the parallel economy.

At first glance, it would seem that no matter what form Bitcoin takes, the number should continue to grow the same with all of these types of the coin. That may be true most of the time, but with bankcoin, that’s only true as long as the company we have bitcoins deposited with is functioning – hasn’t been hacked, hasn’t gone bankrupt, hasn’t had its accounts frozen, has access to the banking network, and can pay out balances.

So the number will grow for everyone equally, but only in KYC-coin and Bitcoin do we have control over our balances and we don’t have to rely on third parties. And that’s the point of Bitcoin.

Collateral for loans

If we get into a situation in life where we need to refinance something and would like to use Bitcoin as collateral for a loan, we can normally only do so if we have private keys. A bankcoin provider can offer its own loan services, but so far few bankcoin institutions do so. If you have private keys (KYC-coin and bitcoin), you have much wider options.

Curious on how to use collateralized loans for tax benefits and enjoying your Bitcoin without having to worry about the price too much?

Check out my course and e-book “How to harness the value of Bitcoin without having to sell it” where I explain how to use Bitcoin-collateralized loans.

Portability across borders

Only cash up to $10,000 can be transferred across the border. By the way, when this limit was created, it was really a lot of money. What we see here is a hidden lowering of the limits – not by legislators, but by inflation. In many European countries, we have limits on cash payments. In Slovakia the limit is €5,000. If inflation is over 10% by the time I write these lines, in seven years €5000 will have half the purchasing power. So we can see that the restrictions on what we can do with our money are only increasing as states print money and thus devalue it.

Electronic transactions also have their limitations – they are under scrutiny, and institutions that arrange transfers across borders require explanations of origin, purpose and so on. For taking my own money across the border!

Bitcoin requires no explanation- if you can send a valid transaction to the network – meaning you don’t have a bankcoin, but a Bitcoin with private keys.

Bitcoin, by the way, is never transferred across borders, it is “in the cloud”, in a decentralized peer to peer network, and it is never located within any single country.

Ease of purchase, liquidity and user experience

We’re getting to the part of the table where we have more question marks and it looks a little worse for Bitcoin. I’ll start with the user experience, where I count the user interface as well.

In the case of user experience, we have question marks in all three cases, and that’s because everybody’s comfortable with something a little bit different in this area.

For me personally, the bankcoin and KYC-coin experience is probably the worst. Filling out contracts and forms, having to prove my identity to someone, and answering questions about things that I consider private strikes me as a very bad user experience. Many argue that it’s a one-time thing and that you just have to suffer through it and then it’s all in a nice smartphone app or web interface and it works. It is only recently that exchanges and various financial institutions have started “refreshing” KYC and AML information on a regular basis. Suddenly we are filling out FATCA forms every year even though we have nothing to do with the USA and therefore their FATCA law. Once in a while we get a request for a current document with an address no older than three months. From time to time, the institution does not like our fiat transaction and asks for clarification of the origin of the money, to show contracts, invoices or tax returns proving the origin of the money.

There are, of course, people who will undergo bureaucracy and annoying questions at random times when they might just want to use their money and are prevented from doing so until they complete something.

Personally, I prefer to learn how to use software wallets or hardware wallets such as Trezor or Ledger. And I’ll find my favorite crypto dealer with whom I trade peer to peer and with whom I talk not about what my tax return looks like, but how life is going, if he knows a good new coffee shop in the area, etc.

Of course, even finding a bitcoin dealer without KYC can have its pitfalls. They don’t always have liquidity – for example, when the price moves sharply, many people may want to buy or sell bitcoin at once. Or the dealer can suddenly raise their fees. Or we may not find any reputable dealers in our area whatsoever and have to solve the problem with some more complex transaction (e.g. a derivative trade, a collateralized loan if we want to buy, or buying gift certificates or using prepaid debit cards if we want to sell).

I don’t recommend doing business with cryptocurrency dealers with unknown reputation at all – it’s a good idea to build long-term relationships with them, use their services regularly, and get to know them a little bit. And only start doing business with people that have good, personal recommendations.

People often ask me if it’s a problem if a cryptocurrency dealer gives me coins that he buys on a regulated exchange with an account in his name – i.e. a KYC-coin, but in his name, not mine. Personally, I think that’s the dealer’s problem, not mine, but I still recommend receiving bitcoin over the Lightning network if the amount is low enough to make it feasible. It saves you time to confirm the transaction and I don’t recommend leaving the transaction without confirmation. Lightning has instant confirmation and also has no transaction history, so we don’t have to care where the dealer’s coins come from. For higher amounts, it may be a good idea to use the Monero cryptocurrency, which has a quick first confirmation and also doesn’t bring over the baggage of the coins’ history.

Despite all this, I find my hardware wallet and a crypto dealer a better user experience than bankcoin and KYC-coin. While most people who use bankcoin haven’t yet encountered anything other than an initial KYC questionnaire, few people will tell you that the questions will also add up over time and you never know how often in advance. Most importantly – the answer to the questions is often a precondition to being able to dispose of your assets as you wish – buying, selling, sending.

So, personally, I prefer to learn the technology and build personal relationships with the dealers. But what is easy for me may be difficult for someone else. My contribution to getting the hang of it is this book and my online courses.

The same applies to Bitcoin as in any other area of life – if you want to start doing something, your first investment should be in education and experience. Surely you know people who want to be more productive. And they are divided into those who just want to (i.e. they are just a bit annoyed that they are inefficient, but they have convinced themselves that it is an unsolvable problem), those who at least educate themselves about it (read books about improving productivity). And then there are those who put what they have learned into practice and so continually improve. With Bitcoin it’s similar – the first investments should go into education, security (hardware wallet) and personal experience (transactions and learning through personal experience).

If you would like to buy your first $1000 worth of Bitcoins, it might be a good idea to buy a hardware wallet, some literature or courses (this book will do for starters). Then don’t invest so much money, but rather invest time. If after spending on a hardware wallet and educational content you are left with, say, 700$, take a portion of that amount (say, half) and buy time from yourself. If your hourly wage is $30, then $350 (of unpaid leave) will “buy” you seven hours of study time. Before you invest time in studying altcoins and “why they are better than Bitcoin” (see the chapter “Fooled by features – why your favorite crypto project is unlikely to succeed, even if it is better”), make sure you really understand Bitcoin – you know how it works, where to buy it (without KYC), you have tried wallet, on-chain and Lightning payment and you really understand how it works. If you want to criticize mining, study how it works. Most people looking for improvements, in my opinion, don’t understand Bitcoin at all, so “improvements” make sense to them. Another good investment is in building a network – get to know the people around you who are into Bitcoin, start a peer to peer trading group. Organize meetups or attend them.

Back to liquidity and user-friendliness: Buying or selling bitcoins from a peer to peer merchant depends on the network of acquaintances we have established. Here, it is good to note that the decision to exchange fiat for Bitcoin does not have to be made at the same time as we convert the fiat form from cash to crypto fiat. Thanks to stablecoins or interest-bearing dollar accounts via derivatives (see chapter “Bitcoin strategies”), we can buy bitcoins when they are expensive and everyone wants to sell them. We can then hedge the dollar value, so we hold dollars and not “expensive bitcoins”. We can then exchange that dollar value for bitcoin when we think the exchange rate is favorable for us.

I explained regular buying in this style in the “Dollar Cost Averaging without KYC” section of the Bitcoin Strategies chapter. If we were not able to buy crypto fiat when everyone was selling crypto, we can use a different strategy – we can borrow crypto fiat using a crypto-collateralized loan. We use Bitcoin as a collateral, we borrow a stablecoin and use it to buy crypto.

This is hacking – we’re gaining experience and we’re playing. We can do all the market interactions in peer to peer mode with huge liquidity. Of course it’s good to try it out before we need it. If you’re all fired up and experienced, you can buy bitcoins directly in your wallet (change the dollar value to bitcoin) or in the lending app (borrow fiat and buy bitcoin with it). If you later meet someone who wants to sell bitcoins, you can buy bitcoin directly (make a rate decision) or crypto fiat (which will allow you to buy bitcoin in the future and postpone the rate decision until later), or repay the fiat loan to the decentralized platform (to repay the loan from a past decision when you didn’t have enough crypto fiat but the bitcoin rate was “good”).

So you can completely separate the decision “now is a good rate” and “I need to change the papers for their crypto form”, they are two things you can do at completely different times. And because of that, you get a user-friendliness that users of centralized solutions can’t even dream of. Sending fiat to an exchange and waiting three days, because you decided to do it on Friday evening? No thank you, I want to be done within 15 minutes.

Inheritance

Another topic where we have a question mark with KYC-coin and Bitcoin is the ease of inheritance. With the bankcoin we have one smiley face that conveys that the state-legislated inheritance process is at least known and it is quite likely that if something happens to us, the inheritance proceedings will go ahead anyway with our other assets. However, neither KYC-coin nor Bitcoin follow the standard inheritance process. Bitcoin is owned by whoever can send a valid signed transaction to the network. The Bitcoin network doesn’t care what the judge says in the inheritance proceedings. Therefore, with Bitcoin, we have to think ahead to the fact that we may not be around forever.

If we are using Trezor T, we can create a backup using the so-called Shamir scheme. This way we can divide the Trezor backup into several parts; we can configure how many parts we create and how many are needed to reconstruct the backup. For example, we can decide to create four sets of backups and that we need any three to restore the backup. One backup each will go to our children, and we can deposit one in a notary’s office along with our will. Or any other way.

It is a good idea to document this process – write a letter about having the cryptocurrencies, how your heirs should access them, and how you wish them to be distributed. Don’t rely on them figuring it out by themselves.

The advantage of a shamir backup is that if, for example, thieves rob one household, the part of the backup stored there is not enough to access the cryptocurrencies, they need two more (any two of the remaining three in our example).

There are, of course, more ways to make sure heirs can access your crypto. For example, you can store bitcoins in a multisignature wallet from which you can spend with one signature and others with multiple signatures or only after some time. Personally, however, I prefer simple solutions that we stick to for the long term.

Please note that from a legal point of view, cryptocurrencies should probably also go through the standard inheritance process, so the heirs shouldn’t just take them, even though they have keys. The “probably” in the previous sentence is because I’m not giving legal advice in this book – consult how inheritance works in the jurisdiction involved.

Also, in the case of bankcoin, it is good if the survivors know which institutions you have an account with. Standard inheritance proceedings do not mean that your heirs will know which exchanges and banks you have an account with, especially if they are in foreign countries. Thus, documenting access, account numbers, contracts, and the like is a good thing even in the case of bankcoin.

That’s why I put only one smiling emoji for the simplicity of inheritance even with the bankcoin – it’s not that simple and it doesn’t happen automatically. Documentation, last will, etc. are important to sort out for bankcoin as well. I think adding a way to hand over the keys if you are already doing such documentation doesn’t make that much difference. Therefore, even if it is an additional complication in the case of KYC-coin and Bitcoin, this problem can be solved quite easily.

For detailed guide, I recommend a book by Pamela Morgan called “Cryptoasset Inheritance Planning: a simple guide for owners”.

Are bankcoin companies evil?

It might seem from this chapter that I have some serious problems with bankcoin companies. Many understand that they are providing an inferior service and want to convince you to switch to at least KYC-coin mode (like Kraken, for example). Many have said they will make NgU technology available to traditional users who already have other investments with them (stocks, bonds, other fiat currencies, …).

Bankcoin companies obviously don’t want to provide bad service and would love to have as many smiling emojis in my table as Bitcoin. The problem is the regulations, not the firms themselves. The reason they are bothering customers with questions about the origin of their money and identity, snitching on them to officials, or freezing their accounts is not because they told themselves they would be evil and make customers’ lives more difficult. It is because regulators have told firms that either they will provide services in this way or they cannot operate or they cannot have access to a fiat network (such as SEPA, SWIFT or ACH).

Some companies have stopped providing regulated services after the introduction of these regulations because they said they did not want to provide an inferior service to their clients. Some companies moved to more favorable jurisdictions or stopped serving customers in companies that are not very crypto-friendly. Many others have continued to do so and have told themselves that they will provide the best service possible under the current regulations. The problem is that the regulations keep getting worse and so does their service.

Companies are either complying with the wishes of governments or they are victims of state violence (company closures, fines, even criminal proceedings against statutory bodies). The sad thing is that we, as customers, perceive the poor quality of service (‘the bank is bothering us again’), but often do not perceive the cause – the bank has to bother us because the state tells it to do so under threat of violence. Any negative emotions about the poor quality caused by regulation should therefore be directed at officials and politicians. Unfortunately, many of these regulations are global (thanks to organizations such as the OECD and FATF-GAFI), but we can avoid some of them by choosing the right jurisdiction. However, it is even easier to exit the regulated environment and enter the peer to peer economy.

Conclusion

In this chapter, I introduced the new concepts of bankcoin and KYC-coin. These terms are not conventionally used, but I think it is necessary to clearly distinguish among the different forms of Bitcoin. We have shown that in almost all areas, bankcoin has significantly worse properties. Where Bitcoin in its own wallet, obtained anonymously, falls somewhat short – liquidity, user-friendliness, inheritance, dollar cost averaging – I have tried to propose solutions that are acceptable or even better than bankcoin.

I think the price we pay for KYC-coin or bankcoin is not worth it. Solving most of the problems of true Bitcoin in peer to peer mode is a fixed cost that we incur once and then only enjoy the benefits. Still, we need to be loving towards bankcoin clients because each person has different priorities and beliefs. And sometimes they just do not have the right information. So let’s give it to them.

Find more content like this in my book Cryptocurrencies – Hack your way to a better life.

It is a guide for Bitcoin and cryptocurrency ninjas. Learn how to use the Lightning network, how to accept cryptocurrencies, what opportunities there are for different professions, how to handle different market situations and how to use crypto to improve your life.

Get it on my e-shop (BTC, BTC⚡️ and XMR and even oldschool plastic) or at Amazon.