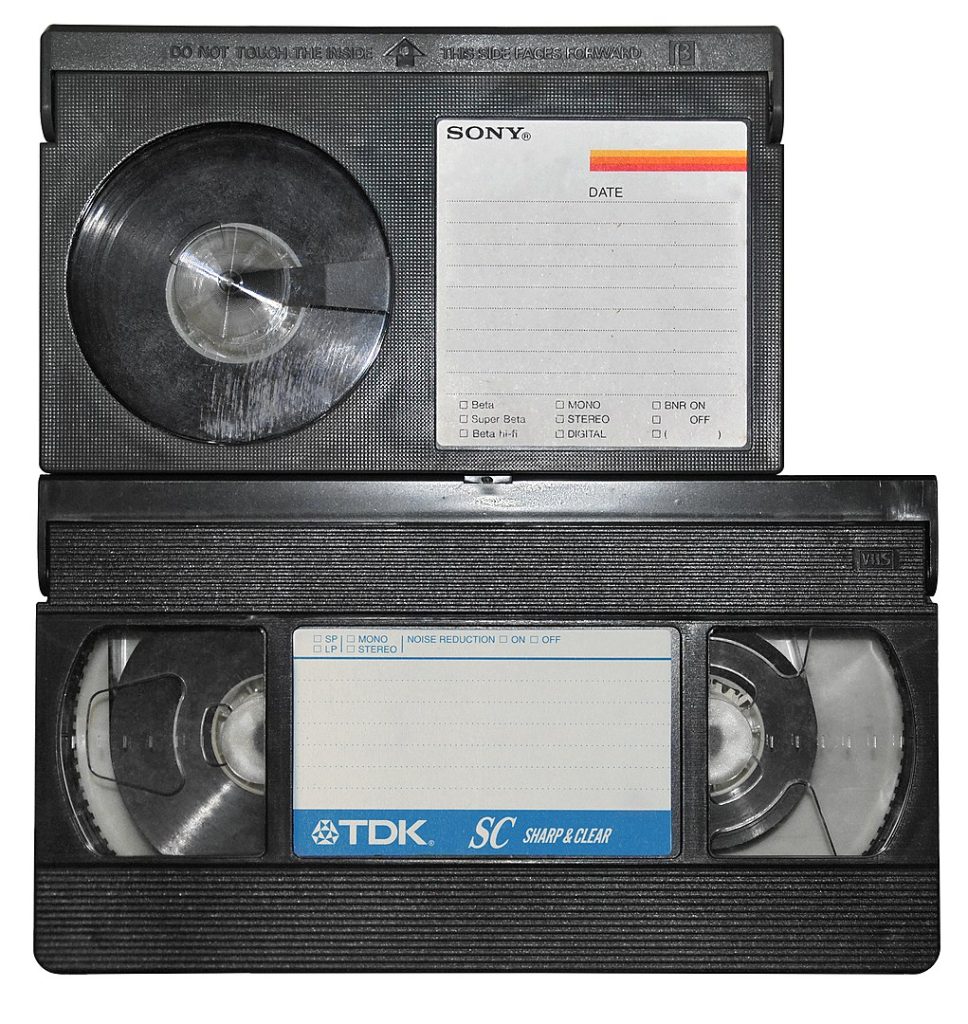

I’ve had several conversations with people about how their favourite cryptocurrency will overtake Bitcoin. And I have often perceived some of the projects’ features as good myself. But before we break down the various arguments and why they are unlikely to lead to success, let’s talk about two technologies that preceded crypto. The first technology is an example of how an inferior technology won thanks to network effects, the second example is how even the network effect didn’t save an inferior project.

The first technology battle we’re going to talk about happened in the 1970s. Sony’s Betamax was a better “videocassette” than JVC’s VHS. The cassette container was smaller, it had better resolution and better picture quality. And yet the VHS format won. Wikipedia describes it like this: “The main determining factor between Betamax and VHS was the cost of the recorders and recording time. Betamax, in theory, has a slightly better recording format than VHS due to resolution (250 lines vs. 240 lines), slightly superior sound, and a more stable image; Betamax recorders were also of higher-quality construction. However, these differences were negligible to consumers, and thus did not justify either the extra cost of a Betamax VCR (which was often significantly more expensive than a VHS equivalent) or Betamax’s shorter recording time.”

JVC, which designed the VHS technology, licensed it to any manufacturer that was interested. The manufacturers then competed against each other for sales, resulting in lower prices to the consumer.

In this case, the network effect won, supported by competition and thus higher availability and lower price. If you’ve lived through the days of sharing movies on videotapes, you would have remembered that with Betamax, you simply wouldn’t have succeeded. The standard format was VHS. And Sony was the first on the market with Betamax, while being qualitatively superior.

But what if someone has already started with the network effect? The second example is MySpace vs. Facebook. Both started with a narrow clientele – MySpace’s target audience was bands and artists and their fans. Facebook initially specialized in connecting university students on a few campuses. At the time Facebook started MySpace had a network effect and looked unbeatable. But in this case higher quality, better user experience and the chosen method of scaling won out. Is it possible to predict which project will win? When are new “features” more important than the network effect? And how does this relate to crypto projects?

Better Bitcoin

A remnant of Bitcoin’s “block size battle” was the Bitcoin cash project, whose philosophy was that people don’t want to pay large fees for transactions, and if Bitcoin is to work as “peer to peer electronic cash system” (which was the subtitle of Satoshi’s original whitepaper), this problem has to be solved somehow. A temporary block size limitation has been inserted in the Bitcoin code as a tool to defend against transaction spam. How this ideological battle played out and who was right is not the subject of this article, all that is relevant is that two opinions have emerged in the Bitcoin community on how to address this issue. One was for low fees, whereby block size doesn’t matter – the idea is that computers are powerful enough to keep even large ledgers of transactions. The other argued that recording payments for coffee in a ledger to be maintained on all nodes for all time was not optimal. The second approach won, Bitcoin Cash is worth less than 1% of Bitcoin at the time of writing, and the demand for cheap transactions is also negligible compared to Bitcoin – the number of transactions processed is significantly lower than Bitcoin in the long run.

It would be easy to mock Bitcoin Cash supporters for being wrong, but I think the goal of having a cheap transaction system is not fundamentally wrong. It’s just that we’ve found that the demand for it is lower than for other qualities of Bitcoin – in this case, it’s mostly about branding and network effect. If you ask someone if they know any cryptocurrency, they will very likely say they know Bitcoin. If they know there are others, they would most probably not be able to tell you a single other name, let alone the properties of these coins and other information about them. If you consider cheap transactions to be an important part of cryptocurrencies, then from your point of view the “inferior technology” has won. Of course, this environment is dynamic – Bitcoin is also evolving and payment networks like the Lightning network are usable and deliver cheap transfer of value despite a somewhat worse user experience.

For smart contract platforms, we have a similar dilemma – Ethereum has high fees at the time I write these lines, due to the huge demand for various smart contract services (the number of transactions in Ethereum far exceeds the number of transactions in Bitcoin, even though they are more expensive). In Asuncion, Paraguay, I had a coffee with a wonderful person who was a “Solana maximalist”. It was the first and so far the only time I met someone with this philosophy – a person who sold all his Bitcoins and bought Solana. His thesis was that Solana scales well and if we want to replace the financial system with some parallel one, we need to be able to handle a lot of users comparable to systems like Visa, Mastercard or SEPA. It’s too early to pass judgment, but at the time of writing, buying Solana during its hype (instead of Bitcoin) wasn’t such a good investment decision. Maybe Solana’s time will come, but I think it’s more likely it will not – and that’s despite the fact that a parallel financial system will indeed need more transactions per second. From my perspective, Solana neglected the network effect of developers and didn’t use existing languages to develop smart contracts.

I’ll mention a few more theses about a “better Bitcoin”. Bitcoin itself doesn’t have that good privacy, it’s too transparent. You can see all the transfers on the blockchain. That’s what projects like Monero or ZCash address. I know both Monero and ZCash maximalists. Or former Monero and ZCash maximalists, to be precise. Isn’t better privacy an important feature? In my opinion, it is. But that’s the wrong question to ask from an adoption perspective – is privacy in Bitcoin so inferior to Monero that thousands of users would do their homework and find out that there’s another cryptocurrency that has better privacy, install a Monero wallet, find out where and how they can buy Monero, and if they already have some Bitcoins, exchange those for Monero? And will they do that even if they look at a chart of the price of Monero versus Bitcoin? In doing so, Monero has segments in which it is being used and the number of transactions is growing. It is popular on dark markets for example, some sellers even give lower prices when paying with Monero. So this is an area where privacy really matters. But will most people take the aforementioned steps because of this, or will they say that if there is no name directly attached to their Bitcoin address, that’s good enough? And of course there’s the privacy aspect of Lightning, which is much better than Bitcoin’s first layer.

Privacy is not the only quality that is important to someone. I had a lot of interesting conversations with someone who was a fan of the Tezos project. The project is promising formally verifiable smart contracts – hence “better security”. If a parallel financial system is going to manage society’s wealth, we can’t afford for someone to hack it every now and then and steal the money from the smart contract. But it looks like even this feature wasn’t enough for Tezos to make it. This is despite the fact that security vulnerabilities in smart contracts on Ethereum are common and people are losing money. Formally verifying code is not easy (we have a whole specific field in computer science dedicated to it), and it’s easier to announce a bug bounty (e.g. through the Hacktrophy project, which I co-founded) and pay for a security audit than to do a formal verification well. And by the way, formal verification doesn’t guarantee anything either – it depends on the specification of what we are verifying. Verification is realistically a mathematical proof of correctness, but are we proving the “right thing”?

Another overpromised, undelivered project has been Cardano – originally an academic project that promised in academic publications that it would make virtually “everything better”. Plenty of academic publications have come out of the Cardano project, everything is being researched by PhD scientists at universities, and occasionally someone will actually release some code.

As with Monero, Tezos, Cardano, AVAX, and other projects are all about the same thing – is what the authors claim to be an uncompromising advantage such that it overcomes Bitcoin’s marketing power, its network effect, and its infrastructure (exchanges, ATMs, wallets, education, trust, …) and get people to actually take action and either buy and use this alternative currency, or perhaps exchange their existing cryptocurrencies for this new cryptocurrency?

I don’t rule out some cryptocurrency coming along at some point and making the switch. It will bring something so revolutionary that it will break through even these barriers – just like Facebook did and completely took over the user base of MySpace in a matter of months. But maybe good old “VHS Bitcoin” is just good enough for what people are dealing with. And they’re using it because that alternative with the new features (whose name they’ve already forgotten) is only used by one weirdo in their community. And then you see a Bitcoin logo on a billboard at a bus stop – used by some exchange or custodian service to promote their services.

And of course there is one more question – what will the majority of people who don’t have any cryptocurrencies buy? For example, a lot of them use stablecoins because they understand what a dollar is and can account and do economic calculations in it.

The idea of “flippening” plays a role in this debate, i.e. a situation where another coin takes over Bitcoin’s dominant position in terms of market capitalization. This used to be the dream of Bitcoin Cash supporters – in case flippening happened, the price of one BCH would be higher than that of one BTC (this would also flip the market capitalization, since the number of BTC and BCH units is roughly the same at any given time). But it strikes me how most people that believe in this imagine it would happen – mostly by people selling their Bitcoins and buying something else. To me, the more interesting question is – what will those people who don’t yet use any cryptocurrencies choose?

Let’s take a look at more reasons why your favorite crypto technology won’t win.

Copy-cats vs network effect

If something doesn’t already have enough network effect, it’s easily copied. A nice example of this is the Monero cryptocurrency, which is based on the CryptoNote protocol and its Bytecoin implementation. But the latter had a rather bad feature – 80% of it was already “premined” by an unknown entity. That is, someone created the first blocks and got a reward for them. This struck the authors of Monero as not very fair, so they took the technology and created the blockchain from scratch, with fair mining and thus coin distribution in place. Since the code was open-source, a lot of people preferred to switch to an instance of the coin that they thought had a more fair distribution.

Other crypto projects face a similar problem – for example, the various better protocols of decentralized exchanges. If they don’t have enough liquidity and users yet, it’s easy to copy their working principle and give users something extra. That’s why even a good idea with good execution can be outcompeted – it’s just too easy to copy it before it has enough users. And those users will simply come around to a better implementation.

Of course, this topic runs into the general problem of open-source software development – the initial development is expensive and difficult, and competitors can take advantage of it and add only their own improvements, which don’t cost as much energy and money to develop. The first-comers have to bear most of the costs, the competitors only focus on their competitive advantage. Yet, with Bitcoin, this copying strategy did not help so far.

Technologies are evolving

Even the cryptocurrency old guy – Bitcoin – is evolving. Technologies like the Lightning network (improving fees, confirmation time – finality, and privacy), Discreet Log Contracts, etc. are coming. Launching a competing project (Monero, Bitcoin Cash) is challenging not only in terms of development, but especially marketing and infrastructure. Legacy technology already builds on existing marketing and infrastructure and can therefore solve some problems “well enough”. What is “well enough” though? In this case, it’s enough to make it not worthwhile for most people to switch to another solution. If paying via Lightning is cheap enough and doesn’t create a permanent record on an (otherwise transparent) blockchain, people can handle a bit more complexity because they can keep their coins, their philosophy, their exchange, and often their wallet, which they can “top-up” just as they did before. Lightning also has a bit of backwards compatibility, so for example if you’re paying a merchant who uses BTCPayServer, scanning a Bitcoin QR code with a Lightning wallet will make a Lightning payment, but if your wallet doesn’t know Lightning, the payment will go the classic on-chain way.

Here we see the fundamental flaw of the static world view. Every technology looks better in the developer’s dreams (i.e. on the whitepaper and marketing materials) than what it wants to replace. The reality will already be a bit different (dreams are rarely fulfilled perfectly), and by the time we get there, even the project we wanted to be better than will have improved. But while the implementation of our dream had to build from the ground up, the existing project only improves on that particular aspect in which we wanted to differentiate ourselves.

An example of this principle can be seen, for example, again in the Lightning network, which was introduced in El Salvador. Salvadorans do not want to pay high fees and therefore use this protocol (in fact, most of them leave Bitcoins in the state wallet Chivo and only make transfers within it). The other currency in this country is the US dollar. Do people want stablecoins? Since most of them already have a state wallet, the wallet provides them with a preservation of the dollar value by using a covered short position on a derivatives exchange. And they are even paid interest (the funding rate) from the position.

Do people want your innovation? Really?

Most experienced entrepreneurs will tell you that one of the most common mistakes they make when launching new products is their assumptions about how customers think. A friend of mine has a restaurant that politicians and somewhat crony businessmen frequent. He thought using Monero with this group was a no-brainer because they all deal with privacy. Only that seems to be a mistake – most people don’t care about privacy, and if they do, they don’t demonstrate it by acting. Opinion is not relevant, what matters is their market decision as to what they choose to do. Everyone likes to complain about the surveillance by big companies and states, but if a person has to choose between a paid encrypted email provider or a “free” product with a slightly better user interface and with surveillance, they’d rather choose the free one. People only care about something to the extent that they choose it over other options. Everything else is cheap talk.

Do people really mind a $30 fee for a decentralized loan? Some do and choose another network, but many don’t mind and are happy to borrow on Ethereum for that fee.

So what people want can’t be invented from the table, but it always has to be tested in the market. Is there really a demand for formally verified smart contracts, an academically fancy cryptocurrency, an environmentally friendly blockchain, privacy or low transaction fees versus something people already have, know and can use?

And even if a given feature (e.g. anonymity) is important, can’t they get it in any other way than by changing the cryptocurrency they use?

You have a really important functionality – but what about the other features?

Imagine if what you wanted really turned out to be important – cheap transactions with fast confirmation, privacy, … And you can deliver. But will you manage to do what other projects have been doing for years? Are you in every cryptocurrency ATM? At the exchanges? Did all the wallets integrate your technology? Does your project need a new wallet or does the existing one that the user already has work?

Developer support

Developer support was once handled perfectly by Microsoft. It created simple development environments for businesses – Microsoft Access, Microsoft Excel, Visual Basic and Visual C++. Companies started making attendance systems, inventory records, or information systems specific to their use in it. And then switching to other software was virtually impossible. Changing the operating system to Linux always involved the question “And how do we run our existing information system on it?” Changing an office suite was often blocked by not being able to answer the question “And does our Excel macro work with it?”. Developer support is extremely important because a lot of energy is invested in development.

If you want to make a new DeFi project, do you need a person who can already code in Solidity (the programming language for smart contracts created by the Ethereum project) and can be found relatively easily on the job market, or do you need them to learn the Rust or OCaml programming language? And if you decide to change technology, will your smart contract in Rust or OCaml work on some other network or will you have to develop it again in a different language?

For cryptocurrency development, the questions to be answered are similar to those for any other software development: how much of what I want to develop is using libraries, and how much do I really need to create from scratch? Are there a large number of open-source projects on which developers can build? Is the development sufficiently documented? Are there examples, tutorials, community on discussion forums? Does anyone do training? Is there an education or development company in every major city or is there one per continent? How many developers are already familiar with the environment? Does anyone organize hackathons?

This is one area where I think the Bitcoin community, for example, has a lot to learn from the Ethereum community. In Ethereum, you have the ability to compose your project from already created components. The development experience in Ethereum is no different than any currently hip web framework – a framework like Truffle will create a scaffold, you can import libraries from pre-made packages, you can test, compile and even push your project to the main network directly from the development environment (e.g. Atom, Visual Studio Code). You have a nice clickable local block explorer. If you’re making a token, you only do the programming that is specific to your project, everything else someone else has already created for you. The development environment has code completion. You have several frameworks for unit testing, documentation, debugger, etc…

Bitcoin is more cumbersome in this – you interact with Bitcoin and lightning nodes via a simple API, and anything more complex is really complicated. I believe Bitcoin will improve in this regard, but that’s also why, at the time of writing, most of the venture capital flows into Ethereum-based projects rather than Bitcoin. Bitcoin is for institutional hodling, Ethereum is for creating. It’s simply quicker and easier to get from idea to functional implementation. But if you’re immediately imagining a mythical flippening based on this, the question still remains – and will it be enough? And another: and is it more important than other things? The reputation of the hard currency, the Satoshi mythology, the amount of users, the more general acceptance, and the existing infrastructure.

What is the product really?

If we are talking about which crypto product will win, we should think about what the product represents. And that’s mainly in terms of what problem it solves. Bitcoin is “hard money”. It is also all sorts of other things (e.g. a payment network, decentralized money, a peer to peer network for uncensored financial communication, etc.). If we have projects that represent “faster and cheaper transactions”, “privacy-preserving financial communication”, etc – how well do they compete with Bitcoin in being hard money?

The answer to this question is important because crypto projects largely address the parallel financial system. And even the existing financial system is built from basic building blocks. An international unit of account (the dollar), a payment network (cash, SWIFT, Visa, Mastercard, …), risk mitigation and hedging products (futures, options, insurance contracts, swaps, …), financial products (loans) and so on.

The question that I don’t know the answer to is – Can Bitcoin remain as the basic building block (store of value and thus hard money) and everything else (privacy, payments, derivatives, security, …) will be built on other foundations but using this building block? For example, I can borrow dollars on Ethereum today and I can use a representation of Bitcoin (for example wBTC) as a collateral for the loan. Why? Because I believe it will retain its value more than other cryptocurrencies. And related to this is the question of value (and therefore price) – if I only use the Ethereum network to borrow dollars using Bitcoin as a collateral, so all the ETH I have is to cover the fees to manage this loan, does Ethereum have a chance of gaining value in the long run? Imagine if you only used the dollars to pay the fees for storing the gold in a bank vault and being able to transfer ownership of it (i.e. pay with it). And you would use gold for everything else. What would a dollar be worth in that case?

Bitcoin doesn’t automatically win

Although this text explores the common fallacies in various investment theses, which are mostly covered by the often desperate attempt to find the “next bitcoin” (i.e., something that will multiply the investor’s net worth by an order of magnitude), it is not an ode to bitcoin maximalism. “Stacking sats”, i.e. desperately hoarding Bitcoins and mocking other uses of the parallel financial system, is a misguided ideology that has nothing to do with why the parallel financial system came into existence in the first place. I mentioned in the introduction that MySpace also had a decent network effect, but in the end Facebook won. All I’m saying is that in this case, if Bitcoin is MySpace, determining ahead of time what is the Facebook that beats it, is nearly impossible. Very often the reasons are different than we think, and it is not decided in the dreams of the authors of these projects (whitepapers), nor by profile pictures on social networks, but on the toughest battlefield (of those where people don’t actually die) – the market. Because it doesn’t matter at all what we think, what matters is what everyone else thinks.

There could be many reasons for Bitcoin’s eventual failure, and perhaps the most brutal could be a loss of trust. Bitcoin, however, can also sleepwalk through time, unresponsive to the needs of users. Bringing new users changes the needs, because the newcomers have different expectations and needs than OG Bitcoiners.

At the moment, the choice of cryptocurrency is more a cultural than a technological issue. The beauty of code, the elegance of data structures or communication protocols is understood by only a very small group of users. Decentralization is also not a binary choice, and for most projects even alternative cryptocurrencies are decentralized enough. People often choose a project through the community. If you’re dealing with cypherpunks, it’s quite possible that if you want to do a Bitcoin onchain transaction, they’ll look at you like you’re about to start undressing on a crowded street. If you’re among the fans of NFT art, you probably won’t succeed with the story about selling all the chairs at home to have more satoshi. However, if you are dedicated to burning the sins of central bankers with your laser eyes on social media, anything other than Bitcoin is supporting the enemy.

Thus, the success or failure of projects is often a cultural phenomenon. Going against the culture and network effects is like swimming against the current of a river – some may succeed, but most swimmers run out of breath after a while. So a market outcome is often an emergent phenomenon – lots of little events that add up to an outcome. It takes a great deal of humility to realize all this – especially when we have to accept that something of great value to us doesn’t matter at all to most people. And that’s why your favourite crypto-project is unlikely to succeed. Even if it is Bitcoin.

This is a chapter from my upcoming book Cryptocurrencies – payment network of the Internet. Stay tuned!

Photo by Joshua Rondeau on Unsplash